Inser at the side of the community: important donation to the Table of Providence in Trento

Inser at the side of the community: important donation to the Table of Providence in Trento

Signed agreement to donate over 100 thousand euros in three years

We are proud to announce our most recent commitment in the field of social responsibility: an agreement to donate more than 100 thousand euros to the Table of Providence in Trento. This contribution, spread over three years, symbolizes our long-term commitment to the Trentino community and reflects our vision of a company that goes beyond business logic.

The Mensa della Provvidenza, located in the former convent of the Capuchins, is now managed by the diocesan Caritas of Trento, which continues the work begun by the Capuchin friars. It represents a bulwark of support and assistance for less fortunate people, providing them with meals and comfort. Recognizing the importance of this service, we decided to support the Canteen with a donation as of this Christmas 2023.

This gesture of solidarity stems from the agreement with Verlingue, which has recently acquired a majority in INSER, and ISA, a minority shareholder.

At INSER, we strongly believe that business success must go hand in hand with contribution to society. Our initiative in favour of the Providence Table reflects our conviction that every enterprise can and should be an agent of positive change in society.

News

Invest in employee well-being with the assistance of Inser

Invest in employee well-being with the assistance of Inser

How and why to guarantee new welfare policies within the company

In recent years, the concept of corporate welfare has taken a central role in successful strategies, becoming a key element to attract, motivate and retain human resources, as well as offering the company benefits in terms of tax and contribution reductions.

Its correct application improves the quality of life of the employees contributing to their psychophysical well-being, increases motivation, productivity and loyalty to the business, finally guarantees economic benefits to the company itself, which can reduce labour costs and increase its competitiveness in the market.

We can define it as a system of non-monetary benefits with the aim of improving internal well-being. Its key element is flexibility, as the company assigns the employee a credit that can be used to compose a basket of specific benefits.

a) contributions for the education of children;

b) crèche and childcare services;

c) discounts and discounts for cultural events;

d) supplementary health cover;

e) repayment of interest on loans, thus support for the purchase of the first home;

f) childcare services (babysitting) during working hours;

g) contributions to the pension fund;

i) financial support for the education of children;

l) holiday facilities;

m) gym passes or physical activity incentives;

n) opportunities for training and personal development, such as study holidays;

o) elderly support who need assistance.

But if a company policy based on welfare is important for the employee, it is also important for the company for the following reasons:

a) improve and increase the retention and motivation of human resources;

b) optimises wages by reducing costs through non-monetary benefits;

c) builds a solid corporate identity by demonstrating the company’s commitment to the well-being of employees;

d) improves internal and external reputation by increasing employee satisfaction by attracting new investment.

To get the most out of these benefits, it is essential to work with industry professionals and use appropriate tools. Inser can be the ideal partner thanks to its vast experience in the design and implementation of programs and policies focused on corporate welfare that can be provided through the Cassa di Assistenza Integrativa called "Fondo Tutela". It is the tool developed by Inser available to companies in order to obtain care treatments, in the mutual sector, and favourable economic conditions for its members in relation to their needs.

News

Protecting corporate credit: Inser's immediate solutions

Protecting corporate credit: Inser's immediate solutions

In today's turbulent economic landscape, businesses face unprecedented challenges, one of which is credit protection

More 6% in 2023 and more 10% in 2024. These are the numbers of global corporate insolvencies according to a recent study by Allianz Trade, which adds a small caveat: the figure is set to rise. Going even more specific, more than 8 thousand cases of legal insolvencies are expected in Italy at the end of the current year (the increase from 2022 is 15%) and more than 10 thousand during 2024.

The causes may be subject to different factors, among them prolonged pressure on profitability, reduced cash reserves, and restrictive financial conditions that have been prolonged longer than expected.

These numbers should give pause for thought about how extensive and real the insolvency system is, especially at the end of the last, difficult economic period.

Since businesses are the growth engine of society, we believe that protecting and controlling credit are among the main actions for the development of businesses, thus the country. Through its specialized team, Inser supports you in finding the best credit protection insurance coverage, providing effective tools against the risk of default, and does so through policies tailored to each company.

These include:

Short-term trade credit insurance

This is a type of policy that covers losses resulting from the non-repayment of trade receivables that have short-term deferrals: if the customer is found to be insolvent, trade credit insurance can cover losses up to a specific amount.

Medium- to long-term credit insurance

It follows the same principle as short-term credit protection, but is designed to insure the business over a longer period, up to a maximum of 60 months. It is a suitable form of policy for companies managing long-term contracts.

Export credit insurance

It is a form of protection for leading export companies, and covers the risks associated with international transactions even on the individual customer-including any risks of political instability in foreign countries.

Credit insurance for small businesses

Inser is working daily to ensure that even small and very small businesses can benefit from the necessary protection, offering greater financial security against non-payment. These are policies tailored to each client's needs.

Constant monitoring

In addition, we offer services aimed at assessing the risk associated with your debtors through analysis of their financial strength and economic conditions that may change over time, as well as providing ongoing advice and support to develop the best credit management strategy.

At a time in history when economic challenges are multiplying, relying on a trusted partner becomes essential to the survival and success of your business. As a result, credit protection becomes the key strategy to ensure the resilience and prosperity of Italian businesses.

News

New acquisition for Inser Spa in Friuli-Venezia Giulia: EnneEmme srl joins the Group

New acquisition for Inser Spa in Friuli-Venezia Giulia: EnneEmme srl joins the Group

Inser is still growing in Friuli-Venezia Giulia thanks to the recent acquisition of EnneEmme Srl, a brokerage company founded in 2009 by Dott. Marcello Nobile

EnneEmme has consolidated over time a valuable and close relationship with customers, and with the entire Friuli market, ensuring over time a personalized and tailored advice for the protection of its policyholders, also thanks to the application of technical specifications of "Risk Management and Loss Prevention".

For over forty years, Inser has been guaranteeing an innovative and high-standing brokerage service throughout the country, as well as a constructive dialogue with all client companies, focusing on relationships and human relationships; a real model of proximity consulting, able to protect the communities and businesses that have chosen to share their path with our consultants. There is therefore great enthusiasm in sharing this news, but also the certainty that the acquisition of EnneEmme srl will contribute to a more decisive and interesting competitiveness in the Friulian territory.

News

Investing in culture: Inser and support for Lorenzo Lotto’s exhibition in Bergamo

Investing in culture: Inser and support for Lorenzo Lotto’s exhibition in Bergamo

We have always considered culture as the engine of the development of society and as a space for individual and collective growth.

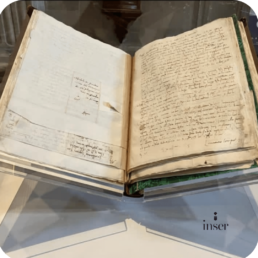

For us, investing in culture means giving value to the past, strengthening the present and directing the future on the tracks of progress. For this reason, when we had the opportunity, within Bergamo and Brescia Italian Capitals of Culture, Inser helped promote the exhibition of "The letters of Lorenzo Lotto and the inlaid choir of Santa Maria Maggiore"from 13 April to 31 May 2023 at the Basilica of Santa Maria Maggiore, in Bergamo.

The growth of a community comes above all from the attention that, as a society, we turn to the culture, cradle and history of our civilization. We thank those who gave us the prestigious opportunity to contribute to exposing the letters and, consequently, to increase the spaces and cultural opportunities of the city of Bergamo

News

Inser: a fundamental support to the 2nd Galileo Padel Cup of the Lions Club Padova Galileo Galilei

Inser: a fundamental support to the 2nd Galileo Padel Cup of the Lions Club Padova Galileo Galilei

Inser, a company that has always been committed to social and community issues, has supported the 2nd Galileo Padel Cup, a charity amateur Padel tournament organized by the Lions Club Padova Galileo Galilei.

The event took place on Saturday, October 14 at the Guizza Padel Center, in via Guido Gozzano in Padua.

It was an initiative that highlighted the importance of joining forces to help those who need it most: the whole day, in fact, was organized to support the service of the Galileo Galilei Padua Lions Club dedicated to Childhood Autism.

Inser enthusiastically embraced this charitable cause, recognizing the importance of helping to improve the lives of the children and families involved.

For us and for all the participants it was an extraordinary day in which the passion for sport was combined with support for others.

News

Business claims: from threat to opportunity

Business claims: from threat to opportunity

We offer a full range of insurance services designed to protect you from direct damage and business interruption

Companies, large or small, are constantly exposed to a series of operational risks that can compromise the financial well-being and continuity of the company: fully understanding its effects is essential to ensure the survival of its business. In this article we will explain how Inser can help you protect you from material and intangible damage in a comprehensive and targeted manner.

The claims, a thorn to the survival of the company

Corporate casualties take many forms, including fires, floods, theft, vandalism and workplace accidents. These are all events that cause significant material losses, putting the survival of the company at risk.

But in addition to direct damage to property and structure, claims can cause long-term economic damage. It is so-called intangible damage, such as loss of customers due to a compromised reputation, legal costs and income losses due to business interruptions, maintenance of personnel costs or expenses related to electricity supplies.

According to the latest data provided by Union Camere, the cost of indirect damage is on average twice as high as the direct one, which underlines the importance of protecting the company from this type of risk.

Business interruption

Inser offers a full range of insurance services designed to protect you from direct and indirect damage. In particular, in addition to including cover for each type of claim, we offer an innovative solution linked to business interruption, so as to protect the corporate contribution margin. The latter is very often neglected insurance, but it plays a crucial role for those who are forced to suspend their activity even if, on the other hand, it continues to bear significant economic costs.

Protecting you is more than a moral duty, it is a necessity: safeguarding the present, protecting the future and supporting the company and its employees is a commitment that Inser can offer you with tailor-made insurance solutions.

News

Addressing Environmental Damage: Inser and Protecting Businesses

Addressing Environmental Damage: Inser and Protecting Businesses

In the current landscape, awareness of the impact of business activities on the environment has become crucial not only to ensure sustainability, but also to preserve the financial soundness of the companies themselves.

The environmental damage comes from multiple sources with devastating consequences for both the ecosystem and the company budget. In this context, Inser is a reliable partner for companies, guiding them in risk assessment and management, as well as in the choice of appropriate insurance solutions.

Environmental damage, from theory to reality

Leakage of chemicals into the environment, pollution of water and air resources, dispersion of hazardous waste, greenhouse gas emissions entail significant environmental damage that can have long-term effects, affecting human health, biodiversity and the stability of ecosystems.

In these dramatic circumstances, companies that do not pay attention to risks face multiple threats. First, regulatory sanctions can result in significant fines and, in some cases, the closure of business. Secondly, the environmental damage caused by the company can damage its reputation, discourage investors and alienate consumers.

Risk Management

Inser supports companies in the management of probable environmental risks in an accurate and comprehensive way, using the expertise of important partner companies such as HDI Global, CHUBB and AIG. The risk management process involves identifying potential risks, reducing them and, where they are no longer reducible or disposable, transferring them to the insurance market with adequate coverage.

insurance solutions

In this context, Inser plays a role as a reliable consultant offering, through tailor-made insurance solutions, a financial safety net for companies that have to bear significant costs for environmental damage, including legal costs, of remediation and restoration.

News

The story of Marta and Chiara: an example of Inser’s best practice in insurance for travellers abroad

The Story of Marta and Chiara: an example of Inser’s best practice in insurance for travellers abroad

When you decide to travel abroad, it is essential to have adequate insurance coverage for the specific needs of your trip. To explain why, we will tell the story of Marta and Chiara (the names are fictional), two Italian girls who lived a difficult experience in Nicaragua and how Inser intervened decisively to ensure their safe return to Italy.

Sometimes traveling abroad involves risks and challenges that can vary greatly depending on your destination and planned activities. For this reason, it is essential to have a competent expert at your side to ensure the tranquility and safety of travelers, sure to be protected in case of unexpected events.

The story of Marta and Chiara

Marta and Chiara, two brave Italian girls, decided to go to Nicaragua for a period of time as volunteers for Doctors Without Borders. Before the departure they had taken out travel insurance directly with a tour operator, who often does not have the same technical skills as an insurance broker experienced in the field. During their stay they found themselves in a difficult situation when they were involved in a serious road accident.

The accident forced them to go to a local hospital, where they faced challenges related to the quality of health compared to Italy. However, the main problem was repatriation in a short time, an emergency given the seriousness of the health conditions. The insurance coverage available to them did not provide assistance for a quick return to Italy, thus creating a further complication.

It is in this situation that Inser, thanks to the experience of its international insurance experts for those traveling abroad, has managed to organize the repatriation of Marta and Chiara in just three days.

The role of Inser Spa and the experts in the insurance industry

The story of Marta and Chiara clearly shows how essential it is to rely on a competent insurance consultant when traveling abroad.

Thanks to our extensive experience in the international travel insurance industry, we are able to ensure the protection and tranquility of our customers with a wide range of tailored policies that include medical emergency guarantees, accidents, cancellation of the trip, loss or theft of luggage and different other.

Relying on an experienced and specific team, even more if you travel to distant countries, can make the difference for a timely solution of the problem.

News

Parametric insurance, new frontier of insurance

Parametric insurance, new frontier of insurance

Parametric policies represent an innovative form of insurance that offers coverage based on specific, predefined and measurable parameters.

It is a solution offered by Inser Spa, which differs from traditional policies because it determines the payment based on the occurrence of a specific natural event, or the achievement of a predetermined threshold.

Concrete examples of use

For an event to be considered eligible as an insurable trigger, it must be fortuitous, or outside the policyholder’s control. This means that the event must be objectively measurable and verifiable, so as to ensure transparency in the determination of compensation.

How the insurance works

Benefits for insured persons

The role of Inser